Reflections on Hyperwallet’s Continued Growth as Part of the PayPal Family

Last month marked the one-year anniversary of PayPal’s announcement to acquire Hyperwallet and our payout platform. While mergers and acquisitions are never easy, I can personally say that I could not be more pleased with the way things have turned out for the Hyperwallet team. While we’ve always been a resilient company, joining the PayPal organization has helped bring us one step closer to achieving our ultimate vision to pay the planetTM.

On the commercial front, our growth has already increased significantly. In the past 12 months our team has been able to onboard and deliver payout solutions to a range of notable brands, including two certified unicorns: micro mobility platform Lime and the global insurance company Lemonade. Under PayPal’s leadership, we have also expanded our payout platform offering to help solve a range of issues in the airlines industry through a partnership with numerous carriers, including WestJet. As the complexity of global disbursements continues to increase, we remain dedicated to our goal of providing growing organizations with a frictionless, transparent, and reliable way to not just send payments globally, but also provide their end beneficiaries with the best experience possible.

On the product side of the house, we’re already hard at work integrating PayPal’s processing technology and product offering into our financial network. To provide even more optionality to our payees, we recently expanded PayPal as a transfer method to include an additional seven currencies, an option that quickly became the preferred payout type for many on-demand economy freelancers and digital marketplace sellers. Our financial products team continues to integrate more robust payment options into our network. Local bank transfers (e.g., Hong Kong Faster Payments), e-wallets (including Venmo) and cross-border direct-to-debit push payments (better known as OCT, Original Credit Transactions) are already on the roadmap for later this year. When it comes to payout optionality, Hyperwallet remains a global leader, providing fast and secure payout optionality to more than 200 countries and regions.

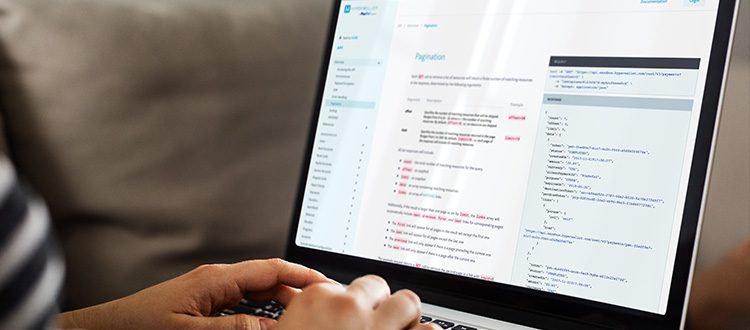

Finally, when it comes to our developer community, we’ve remained attentive, releasing a handful of new tools (with more in the works!). This includes working with our friends at Braintree to improve our developer offerings, as well as releasing iOS and Android SDKs. While our Pay Portal Payee Experience remains a popular option for some clients, an increasing number of merchants are turning to Hyperwallet’s REST APIs and drop-in UIs to fully own the payout user experience. Along with new mobile SDKs, developers can also expect to see enhancements in our documentation. Built based on feedback from developers and merchants, this revamped “Docs 2.0” portal will act as a central knowledge hub for all things Hyperwallet. Watch for more information on this later this year.

At Hyperwallet, we want to do more than simply deliver payments. We want to make the entire experience frictionless, both for the merchant and the end beneficiary. By providing our clients with access to a fast and broad financial network (now with processing power from PayPal), as well as an intuitive UI, we’re confident that we can continue to make good on this promise. It’s been a crazy year, but it’s safe to say we wouldn’t be here without the trust and support from our hundreds of merchants and millions of payees around the world who continuously push us to be a better company and deliver an exceptional product.

Thank you for your support; I can’t wait to see what the next 12 months holds!