Hyperwallet’s Take on Payee Verification

Last year 14.4 million US consumers became victims of identity fraud — or, about 1 in 15 people. If that wasn’t bad enough, out-of-pocket fraud costs are continuing to increase. In light of these figures, and other instances of cybercrime, organizations are always doing their best to avoid becoming a statistic. That’s where Hyperwallet’s payee verification technology comes in.

Put simply, payee verification is the process of gathering data and confirming the identity of the recipient of funds – whether an individual or business – before initiating a payment transfer. With the rise of online fraud, payee verification is now considered a security measure that’s not only important for data protection and fighting against fraudulent activity, but is also paramount to protecting a business’ reputation. Because global verification requirements and payment industry regulations can be complex and dependant on a multitude of factors, including geography, Hyperwallet strives to give organizations, and the payees they serve, a trusted ally.

What’s the Payee Verification process like?

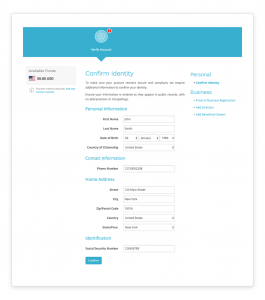

Hyperwallet’s payee verification process aims to match a payee’s personal information, which is provided by the paying organization during registration (or account activation), and that of the recipient requesting a payment transfer. This confirms that funds will be transferred to the intended payee; it also has the added benefit of giving payees peace of mind by reducing unauthorized transactions using their identity.

Hyperwallet’s technology has the ability to verify both individuals and business entities:

- Verifying an individual payee is a relatively simple and linear process, in which personal data is compared against the profile information provided upon registration; if the data entered by the payee is accurate, the verification is complete, if not, documents validating the profile must be provided by the payee.

- Verifying business payees is more of an elaborate process, in which the business contact, or individual authorized to represent the business, is required to submit personal details. If automatic verification fails, the business contact will be required to upload identifying documentation (such as a business profile, company directors and beneficial owners’ information, letter of authorization, etc.)

In both cases, Hyperwallet also performs re-verification when documents submitted do not meet the required criteria, or when updates have been made to the payee profile.

Accessing the Payee Verification functionality offered by Hyperwallet

Hyperwallet supports 4 different payee verification integration methods, depending on the Payout Experience you choose.

Pay Portal Payout Experience

The Pay Portal Payout Experience comes with payee verification natively integrated, so there’s no additional build or developer resources required. If, and/or when, payee verification is required, an email notification is sent to the payee requesting additional identification data. The email then redirects the payee to the Pay Portal, where they are required to enter their data and submit documents, if necessary. This process is automated and triggered when data from the payee is missing or incomplete on the account. The info is verified against the data provided during the payee registration process, account activation, and third-party sources. See the Payee Data collection documentation for Payee Verification in the Pay Portal Experience.

Embedded Payout Experience

The Embedded Payout Experience offers 3 ways to tap into payee verification, and you might favor one over the other depending on available developer resources, and your timeline to get up and running.

- Managed payee verification provides an alternative for organizations who aren’t able to use the API or Drop-in UI methods, or for organizations who use a third-party integrator that does not allow for any external drop-in UI to be embedded. While no developer integration is required, this option provides limited control over the payee experience. When enabled, Managed verification triggers a notification from the Hyperwallet system to the payee in question, directing them to complete the Managed verification process. Managed payee verification performs verification on both individual and business payees, and has default Hyperwallet branding. Visit our documentation on Managed payee verification for more details.

- The Drop-in UI allows you to embed and streamline the payee verification process within your existing website through a simple integration of a few lines of code. The payee verification drop-in UI supports both individual and business payees and requires some integration expertise to embed into your existing website. This functionality is configurable and can be styled to match the visual design of your payee interface. See our documentation for more details on the payee verification drop-in UI.

- Lastly, the payee verification API requires the most developer savvy to implement, but allows for increased control over how this functionality is integrated into your existing web site or application. The API performs verification on both individual and business payees, and is used to check the payee details of a given account. Based on inputs given in a request, the API validates the payee details and shares the verification success or failure response against the details received in the request. See Hyperwallet documentation for more details on integrating payee verification via API.

Which method of Payee Verification is best for my business?

If you are an organization that uses the Pay Portal Payout Experience and your configuration requires payee verification, the payee verification is already built-in, and no additional build is required.

If you are an organization that uses the Embedded Payout Experience, you can opt for either of the 3 payee verifications, namely Managed, Drop-in UI, or API. The option you choose depends on your developer resources, the timeline you have to get it up and running, as well as the level of control you wish to have over your payee experience.

The following table provides a comparison of the 3 payee verifications available for the Embedded Payout Experience:

| Managed | Drop-in UI | API | |

| Developer resources needed | No | Low | Medium-High |

| Control of the payee experience | No | Moderate | Full |

| Individual and business verification | Yes | Yes | Yes |

| Speed of implementation | Immediate | Fast | Variable |

Regardless of how you choose to implement it, Hyperwallet’s payee verification functionality is designed to help reduce the probability of your organization – and your organization’s payees – becoming a victim of fraud and identity theft. What’s more, this tool helps to validate that funds are being sent to the intended recipients – which is necessary when it comes to maintaining compliance with global payment regulations and offering a positive payment experience.

Ready to enable Payee Verification as part of your payout configuration? Contact one of Hyperwallet’s payout experts today to learn more.