APIs and the Integrated Ecosystem Effect

APIs (or application programming interfaces) are amazing tools. When integrated properly, APIs have the power to facilitate beautifully symbiotic relationships. Consider Uber’s Request API that rolled out earlier this year. When the ridesharing application opened up its platform to third-party integrations, suddenly any service could have access to Uber’s driver network. Food and retail platforms can now tap into the platform to improve their delivery services, while airlines or hotels can provide guests with Uber booking options from within their native applications. By offering up its APIs and sharing data with other businesses, Uber has essentially given any platform permission to piggy-back off of its success.

Altruism aside, Uber’s Request API ultimately means more passengers in Uber’s seats, a better experience for Uber’s user base, and—most importantly—more money in Uber’s pockets. That’s the power of the integrated ecosystem effect.

Integrated Ecosystems and the Power of Support

Integrated ecosystems are emerging everywhere. Take the burgeoning Airbnb support ecosystem, for example. Even though Airbnb does not currently offer a publically available API, the company has inspired a whole new cottage industry layered on top of their platform. Third party services like Guesty and Guesthop all exist to help ensure a more positive experience for hosts and renters.

In a world where access trumps ownership, sharing data and functionality is a natural fit. In both of our examples above, an already-dominant player has successfully opened new avenues of customer engagement and revenue generation by letting emerging companies tap into their network. It’s a brilliant strategy, and one that’s beneficial to the growth of both platforms. Of course, Uber and Airbnb aren’t alone. As this new economy grows, I believe we’re going to see more businesses adopt an open approach to data sharing and experience integration—for their consumers and, more importantly, for their workforce.

Taking Collaboration to the Next Level

Including worker and supplier service integrations through API hooks is an easy and effective way to ensure access to value-added operational tools within your platform. And this is true for both consumer and worker-focused tool integrations. After all, establishing integrated ecosystems for both groups of users drives “stickiness” on your platform and increases revenue-generating activity.

Take payment integrations, for example. On the consumer side, platforms aren’t just comfortable integrating merchant processing systems (like Paypal, for example) into their user experience, their business is dependent on them. This is because these payment acceptance providers have, over time, built an extremely reliable network for global funds acceptance. Not surprisingly, platforms are now hungry for a similar integration with an outbound payment solution to service the workers on their platform and offer quick and efficient global earnings distributions. That’s a big ask, and it’s one we’re tackling through an integrated ecosystem approach here at Hyperwallet.

Breaking Down Our Tech

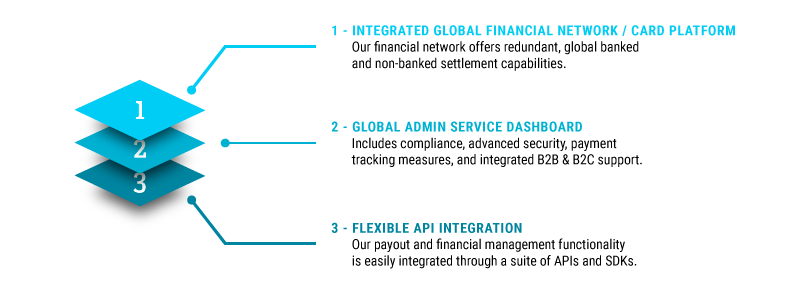

Global payment distribution is difficult. From strict regulatory and compliance requirements to currency and exchange considerations, it’s no easy task architecting a secure and cost-effective solution. Hyperwallet’s original software as a service payment solution was designed to do just that, taking all the hard stuff—administrative hassle, compliance risk, distribution issues, and so on—off of our clients’ hands.

Now, through the use of our payout APIs, we’re able to offer this same payment technology to our clients through a simple, streamlined integration. Once hooked in, our platform requires three basic instructions to execute a payment:

- Who: the person you want to pay

- How: the transfer method the payee wishes to use

- What: the amount of funds to transfer

This information can be collected in a seamless manner through the client’s native application, ensuring a consistent user experience. Everything else (i.e. the hard stuff) is handled behind the scenes on our platform.

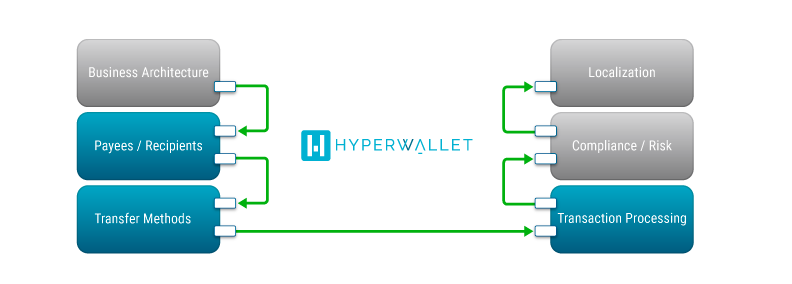

Hyperwallet’s APIs abstract all of the time-intensive and difficult aspects (business architecture, localization and compliance) from the payment process, enabling seamless ecosystem integrations.

So, to recap, APIs are a wonderful vehicle. But APIs won’t work unless they’re used to enable open integration, improved usability, and enhanced functionality between synergistic platforms. Hyperwallet’s payout APIs are engineered to improve all aspects of earnings management and acceptance, functionality that will ultimately increase worker production, promote user affinity, ensure data transparency, and improve your bottom line.

Now that’s an integrated solution.