Solving Global Mass Payments—Once and For All

In the last few years, we have seen the emergence of new players and notable disruption in many areas of payments, particularly in acquisitions, processing, and consumer money remittances. However, very little progress has been seen in cross-border B2C/B2B disbursements.

In its Disbursements Satisfaction Index, PYMNTS notes that while checks account for $22 trillion in US transactions each year, the consumer satisfaction score for paper bank orders is just 4.4 out of 100. Roughly 50 percent of B2B payments are still done by check, and only about 25 percent of businesses use domestic ACH as their primary method for paying their local supply-side contractors, resellers, and suppliers. Not surprisingly, businesses that adopt domestic ACH report higher satisfaction rates due to its low cost, ease of use, and low fraud levels.

That being said, globally-focused businesses face significantly higher frictions when it comes to disbursing payments across borders. Due to the lack of global ACH interoperability, international B2B/B2C disbursements are high-cost and complicated due to unsatisfactory transactions traceability. As such, the role of checks and wires is even more pronounced in international payments.

This prompts the question: what will it take to improve global disbursements? To find out, I’ve looked at some recent research and industry opinions.

1. Recognize that there are many payment types and create interoperability

In the article, “The Future of B2B Payments,” Glenbrook Research notes:

Solutions have to work for both buyers and suppliers in order to achieve critical mass. The network effect is very, very powerful, but it is also very hard to achieve. Beyond the card networks and PayPal very few payments network fantasies have been realized. Glenbrook estimates that no more than 5 percent of B2B spend is through B2B networks. If B2B networks that currently compete with one another for scale would play nice with one another, and be interoperable, then perhaps the pie would grow larger.

The future of B2B/B2C disbursements is a network of networks. Businesses are looking for one simple solution that will enable them to pay anyone, anywhere. There are approximately 3 billion people worldwide that have a bank account, approximately 2 billion Visa and MasterCard cards, and 200 million active PayPal accounts. And don’t forget about the 2.8 billion unbanked and underbanked people around the globe. How do you reach everyone? The key is interoperability.

2. Find ways to improve banking system efficiency and decrease transaction cost

Account-to-account transfers are expensive. In fact, based on recent World Bank data, the average cost of a cross-border account-to-account transfer is more than 7 percent of the principal. There is no reason why we should be paying that much for a service that should be digital and fully automated, just like domestic ACH. We have witnessed many consumer P2P models (e.g., Venmo) and blockchain models (e.g., Ripple) emerge in the last few years, but it still remains to be seen which model will succeed in the long-term. Nevertheless, one conclusion is clear: the current banking system needs to change in order to become more efficient and competitive. In the report named “Global Payments 2015: A Healthy Industry Confronts Disruption”, McKinsey notes:

Cross-border payments continue to be expensive. According to a McKinsey survey on cross-border payments pricing and customer experience in 2015, consumers pay a fee of between €20 and €60 on top of the prevailing foreign exchange spread.

(…) To maintain their strong footprint in cross-border payments, banks need to rapidly move away from the existing correspondent bank model, which is burdened with customer pain points. They must think broadly and strategically about the future of cross-border payments—and do so soon, because the industry is already on the move.

I believe any successful innovation in cross-border money transfer will need to incorporate banks as part of the solution. Instead of labeling banks as their enemy, digital players need to recognize bank’s value add in the global financial system and find ways to make the banking infrastructure more efficient. At the same time, banks need to be open to new types of partnerships and embrace digital disruptors as partners, not competitors. In the same report, McKinsey concludes:

(…) Banks must recognize that digital technologies can do much more than simply automate processes. They must invest to enhance specific aspects of their businesses, but they must go beyond this to institutionalize a mindset of digital transformation, at the front and back end, that will make them more customer-centric and flexible.

3. Solve for user-friendliness and full transparency

While ACH systems have eliminated many of the pain points associated with sending funds domestically, international payments are still governed by decentralized bi-lateral agreements between large banks. This creates inherent problems; problems that Eric McCune documented in an article named “There Is No Such Thing As An International Wire”:

Challenges include:

No direct relationship with downstream banks. If a problem occurs (for example, a payment is not received or is delayed), the sending company—and its bank—may not be able to trace the transaction quickly or reliably.

Cost. With multiple banks involved, each charging a fee and/or taking some share of the foreign exchange revenue, these transactions can be expensive for end users. Often, end users do not know whether costs are also assessed to their counterparties.

Limited data transport capabilities. The payment initiator may wish to send information with a transaction; with multiple bank intermediaries involved, it may not be possible to reliably carry that data through to the receiving party.

Barriers to change. In a decentralized system, it is relatively difficult to implement change. There is no central authority to mandate or direct new processes. Of course, we should acknowledge that SWIFT does play an important role in enabling change through setting and promoting new standards. But it cannot dictate the terms of correspondent banking relationships—so that there is no uniform way, for example, for a sending bank in one country to change the ways in which payments are made by its correspondents in receiving countries. For example, attempts to migrate more transactions to ACH from wire still demand tedious and laborious point-by-point negotiations and implementation procedures.

The future of global disbursements is in front-end simplicity and transparency. Businesses are looking for integrated solutions: transparent pricing structures that they can budget for and access to real-time transaction traceability, for example. At this point, it’s clear that the correspondent banking system will never reach this level of user friendliness; legacy systems simply can’t accommodate this level of accessibility. And that opens space for a new kind of global, ACH-like network.

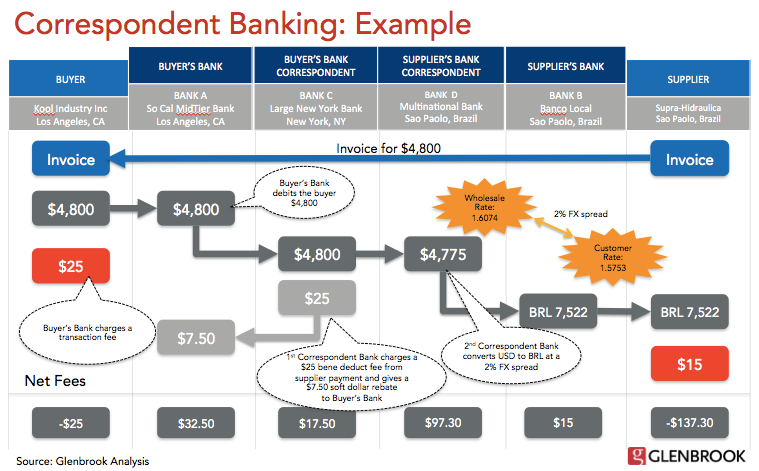

Correspondent Banking Example. Source: PaymentsView

The next generation of outbound payment solutions will rely on purpose-built platforms to provide cost control, data visibility, operational efficiency, and friction-free delivery methods at a fraction of today’s cost. Equipped with integrated payment tracking, compliance, and management tools, these new platforms will ultimately change the way people and businesses get paid in the new economy.