Integrated Payouts vs Standalone Payouts—Why Not Both?

When my family used to run a restaurant, we’d pool all the tips and then distribute them equally among the wait staff. This made the whole process easier and less time-consuming, but it also presented some problems. First, it took away the ability to reward high performers through one-time bonuses. And sometimes, a credit card payment (along with the associated tip) would decline days after we had already paid out our employees.

Even with the evolution of technology, it’s interesting how all manner of business models run into the same underlying strategic problems. For example, two-sided marketplaces today need to make a similar strategic decision when it comes to deciding which payout system to adopt: an integrated pay-in/payout solution, or a standalone payout solution. There are merits to both—but by choosing one method over another, marketplaces are usually accepting certain drawbacks.

The Integrated Pay-In/Payout Solution

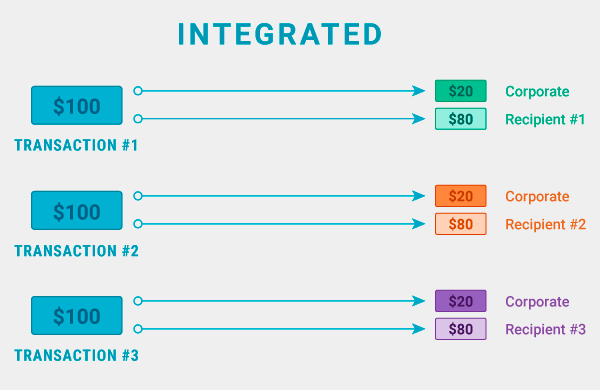

Let’s consider a USD $100 transaction on a two-sided marketplace (Uber, Airbnb, DoorDash). Assume that the marketplace charges a 20 percent commission for the transaction. In an integrated pay-in/payout solution, the solution accepts the USD $100 and sends USD $80 to the recipient’s account and USD $20 to the marketplace’s account. The advantages are quite apparent: the marketplace doesn’t need to worry about the transfer of funds. Since it’s not holding the recipient’s funds, the regulatory environment is easier. Recipients are able to see the funds faster. And because the funds are linked to a specific transaction, it makes reconciliation easier for both the recipient and the marketplace.

However, with this integrated pay-in/payout solution, marketplaces don’t have a mechanism to send additional funds to the recipient. Funds can only come from a credit card transaction. If the marketplace wants to set up separate tiers for its sellers—for example, 20 percent commission on the first 10 rides but 10 percent commission afterwards—they might find they’re not able to support this with an integrated solution. Similarly, if the marketplace wants to pay a loyalty or a one-time bonus, it probably can’t be done with the existing workflow. Chargebacks present difficulties, too.

The Standalone Payout Solution

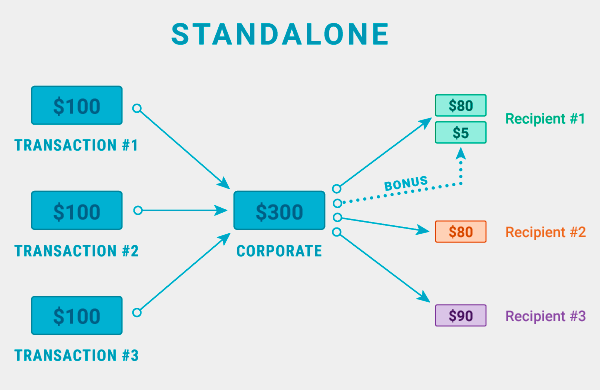

Now let’s look at the workflow in standalone payout solution. A separate pay-in solution will be used to accept the USD $100 payment which will flow directly to the marketplace’s account. The marketplace now has the ability to decide how much of the USD $100 it sends to the recipient. It can charge the usual 20 percent fee or a different amount. We start to see the advantages of this type of a solution over the integrated model. The same workflow can be used to send tiered payments or one-time bonuses. The marketplace can wait for the funds to settle before sending out the payments to the recipients and thus avoid chargebacks. Funds can be collected over a period of time and then distributed, rather than sending a payment for every transaction.

The yang to the yin for the standalone solution is that this involves more steps in the workflow and consequently can take longer for the recipients to receive the funds. It also involves more operational involvement from the marketplace: calculation of the payment, reconciliation of the funds, and more regulatory oversight as the platform now holds funds rather than just pass them through.

Get the Best of Both (Payment) Worlds

Business models with fixed payment amounts for every transaction are a good match for an integrated pay-in/payout solution. Similarly, for marketplaces which have adequate operational resources and where the speed of payments is not a big issue, a standalone payout solution is the right fit. In the real world though, marketplaces require a mix of the two models—the ease of use of the integrated solution and the flexibility of the standalone solution.

One of the reasons Hyperwallet is a preferred payout provider for marketplaces is that we offer a single solution that can support both workflows. Through partnerships with pay-in providers, Hyperwallet is able to provide an integrated pay-in/payout solution where the marketplace never touches the funds and every transaction just gets split between the marketplace and the recipient. And with our proprietary financial network, we also enable a standalone payout solution in case the marketplace wants to aggregate the funds before disbursement or deliver tiered or one-off payments.

In our family restaurant, we solved our payments problem by keeping a small portion of the collected tips in a separate category which would be used to payout one-time bonuses to high performers or to cover chargebacks. But unlike we did those years ago, marketplaces have a bevy of technology-based solutions at their disposal. There’s no reason for marketplaces to simply accept deficiencies in their payout process—with Hyperwallet, they can have the best of both worlds.